A handful of venture capitalists determine the future of technology. The world’s ten leading venture capital firms have invested over $150 billion in technology startups. The venture capitalists who run these firms decide which startups today will develop the new platforms and technologies that will shape our lives tomorrow. There is a startling lack of diversity within the venture capital sector. This means that a small group of predominantly white men make decisions that affect all of us. Unsurprisingly, they often ignore these investment decisions’ broader societal and human rights implications.

We all live in a world shaped by venture capital. As of 2019, 81% of all venture capital funds worldwide are clustered in just a handful of countries, primarily in the U.S., Europe, and China, which in turn are shaping the future of technology. If you spend time on Facebook or Twitter, use Google, travel in an Uber, or stay in an Airbnb, you’ve experienced firsthand the impact of venture capital funding. Venture capital firms, which provide equity financing for early- and growth-stage startups, are critical in deciding which new technologies and technology companies will receive funding.

All businesses — including venture capital — are responsible for respecting human rights. Therefore, venture capital firms must conduct due diligence before making investments to ensure that their assets are not undermining our human rights. Amnesty International recently surveyed the world’s largest venture capital firms and startup accelerators. No one of the world’s ten most tenominent venture capital firms had an adequate human rights due diligence process that met the standards outlined in the UN Guiding Principles on Business and Human Rights.

Unfortunately, this is true of the broader venture capital sector as well. Overall, of the 50 VC firms and three startup accelerators analyzed by Amnesty International, we found that almost all lacked adequate human rights due diligence policies and processes. This failure to carry out adequate due diligence means that most VC firms fail to respect human rights. This almost complete lack of respect for human rights among the world’s largest venture capital firms has three key impacts. First and most immediately, it means that venture capital firms invest in companies whose products and services have been implicated in ongoing human rights abuses, such as companies that support the Chinese government’s repression of the Uyghur population in Xinjiang across China.

Second, venture capital firms continue to fund companies whose business models significantly negatively impact human rights, including our privacy and labor rights. For instance, leading venture capital firms continue to support companies that rely on app-based or “gig” workers, who often face exploitative or otherwise abusive work conditions, and companies whose “surveillance capitalism” business model undermines our right to privacy. Third, venture capital firms’ lack of human rights due to diligence dramatically increases the risk that the funding “frontier” technologies without ensuring that ade human rights safeguards are in place.

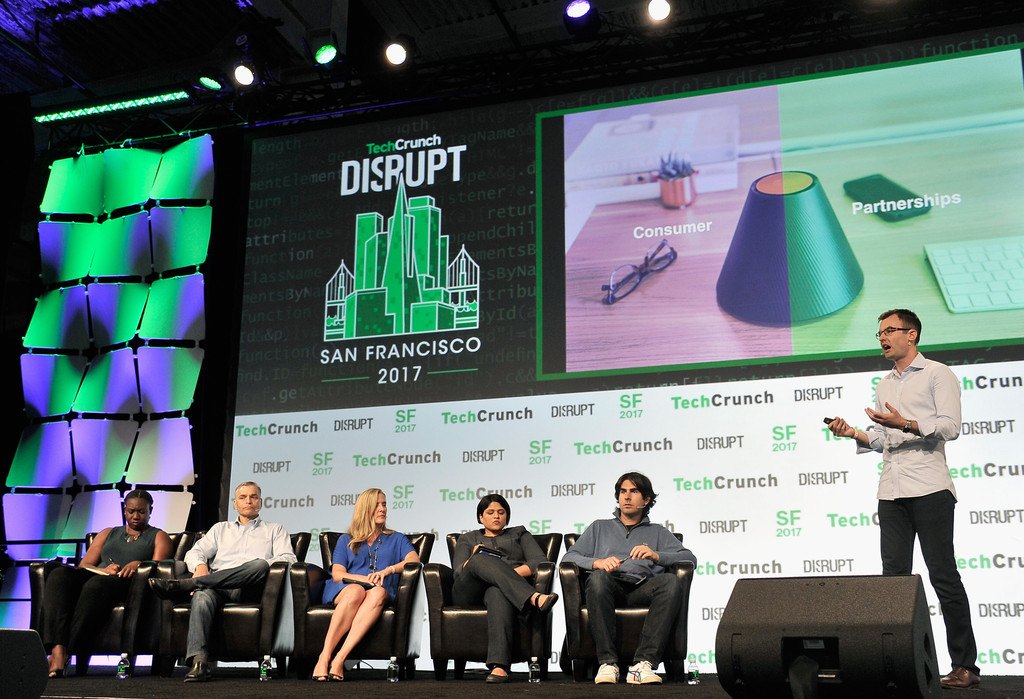

For instance, applying increasingly powerful artificial intelligence/machine learning (AI/ML) tools across various sectors risks amplifying existing societal biases and discrimination. Seemingly objective algorithms can be biased by relying on incomplete or unrepresentative training data and replicating the unconscious bias of those who developed the algorithms. This is a critical blind spot, especially as VC-funded startups seek to disrupt such fundamental parts of our lives as education, finance, and health. The negative impacts of the VC firms’ lack of human rights due diligence — especially regarding issues like algorithmic bias — are magnified by these firms’ lack gendeof r and racial diversity. For instance, women comprise only 23% of venture capital investment professionals (i.e., those deciding which startups to fund).

The numbers are even worse for racial diversity — just 4% of investment professionals at VC firms in the U.S. are Latinx, and only 4% are Black. Groups like Blck VC, Diversity VC, and Digital Undivided have been calling attention to this issue for years, but venture capitalists have been slow to respond so far. This lack of diversity is mirrored in the gender and racial composition of founders who receive VC funding. 2018, all-female founding teams received just 2.2% of U.S.-based venture funding. At the same time, Black and Latinx founders received less than 2.3% of all U.S.-based venture capital funding in 2019.

With power comes responsibility. Venture capital firms must institute human rights due to diligence processes that meet the UN Guiding Principles on Business and Human Rights standards. Further, they should support their portfolio companies to comply with human rights standards. Venture capital firms should also publicly commit to hiring more diverse teams, especially in investment-related positions. Finally, they should publicly save to funding more varied startup founders as part of their flagship funds. VC firms are responsible for ensuring that their investments are not causing harm. A commitment that they have, to date, largely ignored.

Leave a Reply